How to Check Your SSS Contribution Online (2025 Updated Guide)

If you’re a Filipino worker, whether locally employed, self-employed, or an OFW, knowing how to check your SSS contribution online is essential. It helps you track your retirement savings, verify employer compliance, and prepare for loans or benefits. This guide will walk you through everything from account setup to troubleshooting common issues.

📌 Table of Contents

1. Create Your My.SSS Account

- Visit the official website: member.sss.gov.ph

- Click “Register” under the Member Login section

- Choose a registration method: SSS number, mobile, email, or UMID

- Fill in your details accurately, especially birthdate and address

- Wait for the activation email (within 24–48 hours)

2. Login to the SSS Online Portal

- Go to https://member.sss.gov.ph

- Enter your User ID and Password

- If you forgot your credentials, use the “Forgot User ID/Password” option

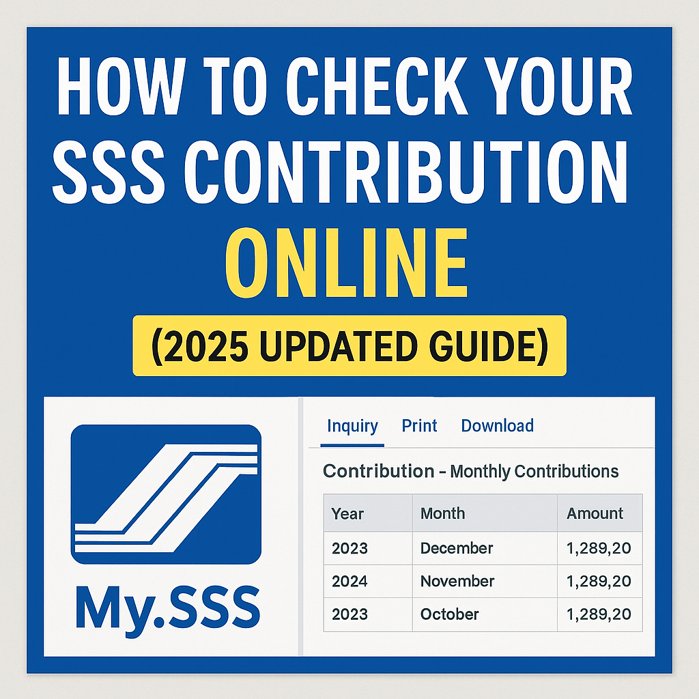

3. View Contribution Records

- After login, click on Inquiry → Contributions

- You will see a detailed table with Year, Month, and Amount

- You can check employer name, payment status, and total contributions

4. How to Download or Print

- Click the Print icon on top of the contribution table

- You can save it as PDF or print a physical copy

- Use this for visa applications, loans, or benefit claims

5. Understanding PRN and Verification

| Term | Meaning |

|---|---|

| PRN | Payment Reference Number used for monthly contribution |

| Status | Should show “Paid” if confirmed |

| Employer listed | Make sure your current employer is listed |

6. Common Issues and Fixes

- Account not yet activated: Check spam/junk email for activation link

- No contributions shown: Contact employer or SSS branch

- Wrong data on file: Update through My.SSS → E-services → Update Info

FAQ

- How often should I check my SSS contributions?

At least once every quarter or after job changes. - Can I check from outside the Philippines?

Yes, the online portal works globally. - What if my employer hasn’t remitted?

Report it to SSS using their hotline or file a complaint in branch.

Staying updated with your SSS contributions ensures you’re protected and informed. Make it a habit to log in regularly and keep your records accurate and up to date.