How to Check for Missing IRS Refunds in 2025 (What to Do If It’s Delayed)

Still waiting on your IRS refund check? You’re not alone. Each year, thousands of taxpayers face delays, errors, or complete loss of their tax refunds. Whether it’s due to wrong bank info, a mail issue, or IRS backlog, here’s how to track down your missing refund in 2025 and what steps to take next.

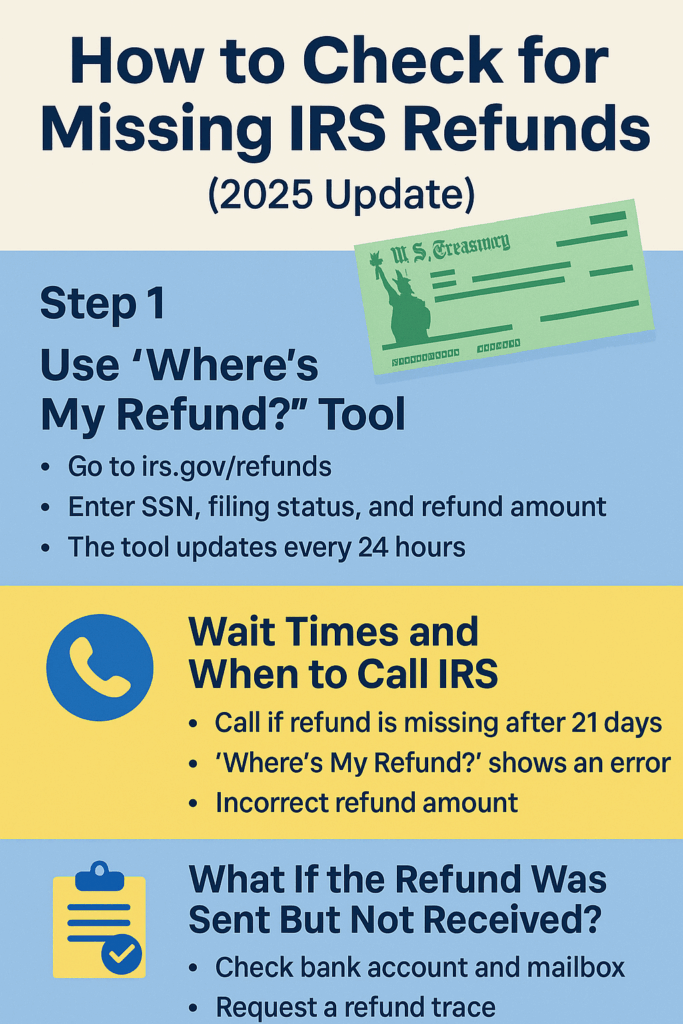

Step 1: Use the “Where’s My Refund?” Tool

- Go to irs.gov/refunds

- Enter your SSN, filing status, and refund amount (exact)

- The tool updates every 24 hours, usually overnight

What the Refund Status Messages Mean

| Status | Meaning |

|---|---|

| Return Received | Your tax return has been accepted |

| Refund Approved | IRS has processed and scheduled your payment |

| Refund Sent | Check or direct deposit has been issued |

| No Information Available | Possible delay or incorrect entry—retry or contact IRS |

Step 2: Wait Times and When to Call the IRS

According to the IRS, most refunds are issued within 21 days. But you should call if:

- It’s been more than 21 days and no updates

- The “Where’s My Refund” tool gives an error for multiple days

- You received an incorrect refund amount

IRS Phone Number: 1-800-829-1040 (Mon–Fri, 7am–7pm local time)

Step 3: What If the Refund Was Sent But Not Received?

- Check your bank account for deposit dates

- Check your mailbox for physical checks (especially if address changed)

- If still missing, request a refund trace

How to Request a Refund Trace

- Fill out Form 3911 (Taxpayer Statement Regarding Refund)

- Mail or fax it to the IRS depending on your location

- It may take 6–8 weeks for resolution

Tips to Avoid Future Refund Delays

- Always double-check your bank info on your tax return

- File electronically and choose direct deposit

- Track your return using the IRS website

Final Thoughts

If your IRS refund is missing or delayed, don’t panic. The steps above can help you track it down, correct issues, or request a reissue. Stay organized, check regularly, and file early to avoid issues next year.